- Kvants Newsletter

- Posts

- 35 companies now hold at least 1,000 Bitcoin as corporate adoption booms

35 companies now hold at least 1,000 Bitcoin as corporate adoption booms

Kvants Insights delivers sharp analysis and key updates for digital asset investors navigating a rapidly evolving market.

KVANTS DAILY NEWSLETTER - JUL 25, 2025

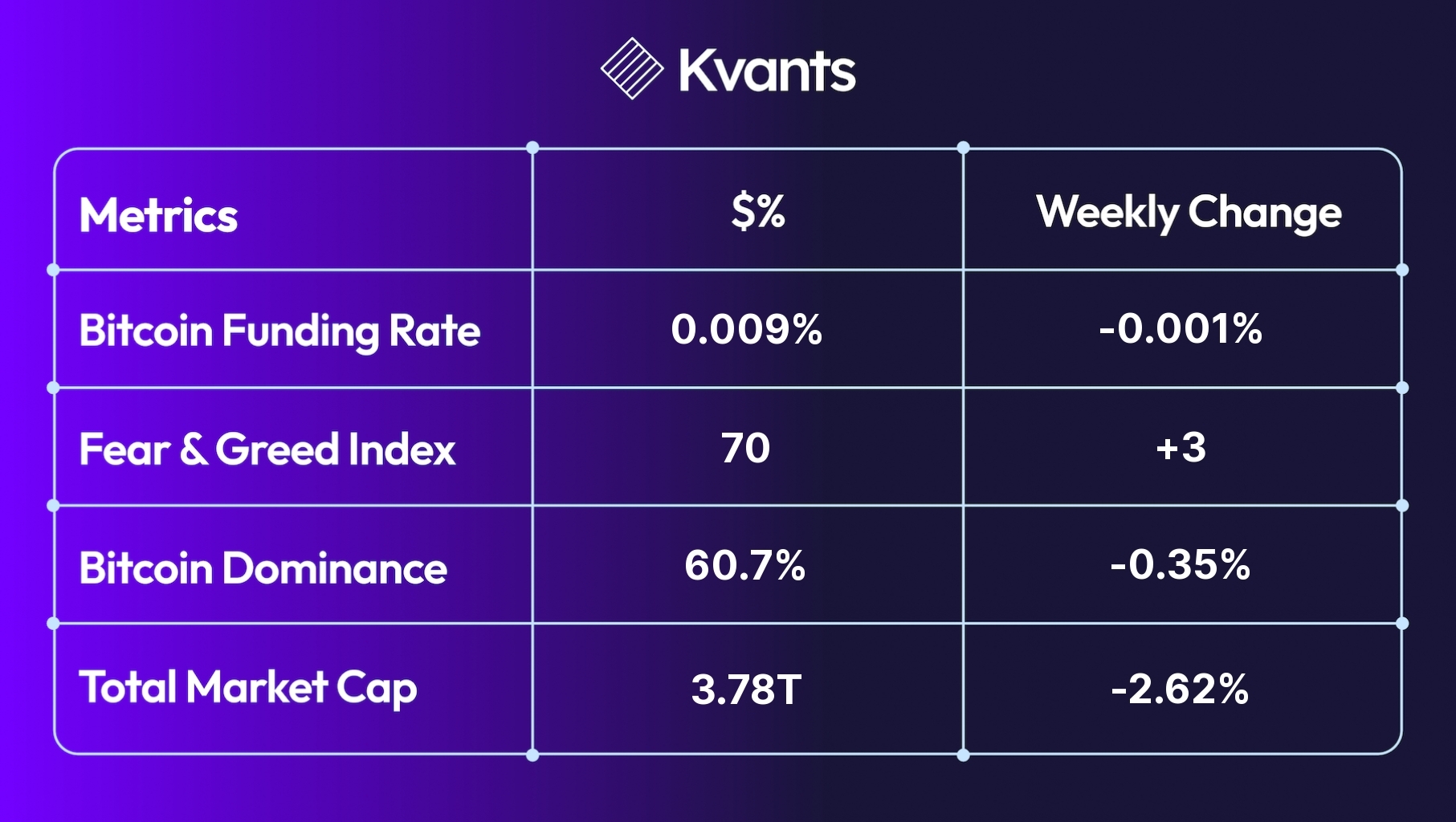

Today, institutional competition for digital assets intensified as Sharplink hired a BlackRock veteran post-BitMine's $2B Ether buy, highlighting Ethereum's rising status as a corporate treasury. Firedancer client experiments aim to advance Solana's speed limits, reflecting the layer-1 efficiency race. Thirty-five public firms now each hold over 1,000 Bitcoin, confirming accelerating mainstream adoption. Major funding, regulatory clarity, and national blockchain deployments signal increased global institutionalization. Quantum computing threatens existing crypto security, urging quantum-resistant protocols. Meanwhile, Nigeria and Vietnam underscore rising regulatory engagement and digital infrastructure leadership, while US prosecutions highlight workforce security risks in crypto sectors.

Sharplink hits back at BitMine’s $2B Ether buy with BlackRock hire Sharplink has appointed Joseph Chalom, a seasoned executive with two decades of experience at BlackRock, as co-CEO in a strategic move to strengthen its position in the competitive corporate Ether treasury landscape. This leadership shift follows closely after BitMine's public disclosure of a two billion dollar Ether acquisition, underscoring the intensifying competition between major public companies to accumulate Ethereum as a treasury asset. Chalom is expected to focus on advancing Sharplink's expansion in global public markets. LINK IMPORTANCE The hiring of a high profile BlackRock veteran by Sharplink directly following BitMine’s substantial Ether purchase represents an escalation in the institutionalization of Ethereum within publicly traded companies. This development suggests that strategic human capital, alongside digital asset accumulation, is a critical battleground for firms aiming to influence and monetize the next phase of Web3 infrastructure. For institutional investors and stakeholders. Firedancer will speed up Solana, but it won’t reach full potential Firedancer, a next generation validator client for Solana, is projected to significantly enhance transaction speeds but remains limited by network constraints inherent to Solana's current architecture. To explore and accelerate its true capabilities, developers like Douglas Colkitt are experimenting with Frankendancer on Fogo, a new Solana compatible blockchain designed to prioritize speed over decentralization by adjusting Solana’s core network assumptions. LINK IMPORTANCE The work being undertaken with Firedancer and Fogo signals a critical effort in advancing blockchain infrastructure by directly addressing the longstanding tradeoff between transaction speed and network decentralization. For institutional investors and technology partners, the implications are substantial as the lessons taken from Fogo's experiments could provide blueprints for future mainstream blockchains that are more efficient yet still secure. 35 companies now hold at least 1,000 Bitcoin as corporate adoption booms Public companies are accelerating their acquisition of Bitcoin with at least 35 firms now holding more than 1,000 BTC each. This marks a sharp rise in institutional holdings up from 24 companies just a quarter prior and reflects rapidly growing corporate demand for digital assets as a balance sheet reserve. Influenced by recent federal policy moves and strong market appetite, these companies collectively control Bitcoin worth over 116 billion dollars. LINK IMPORTANCE This surge in corporate Bitcoin holdings highlights a structural shift in the perception of digital assets by mainstream institutions. Increased adoption by high profile public companies is expected to add legitimacy and long term price support to Bitcoin, while also spurring competitive accumulation by peers seeking yield and inflation hedging. Asia’s OSL Group raises $300M for stablecoin and global expansion OSL Group has secured 300 million dollars in equity financing which is the largest such raise in Asia's crypto sector so far. The company intends to use this capital infusion to drive acquisitions develop global business initiatives such as cross border payments and stablecoin infrastructure and strengthen working capital for its expansion strategy. LINK IMPORTANCE This capital raise will have significant implications for the competitive landscape among digital asset platforms in Asia and beyond. OSL Group's ability to attract substantial equity funding highlights growing institutional appetite for scalable and regulated crypto infrastructure in the region, especially as stablecoins and cross border payment solutions gather momentum. OSL Group's stated focus on acquisitions and global expansion. Quantum computers could bring lost Bitcoin back to life: Here’s how Quantum computing advancements are creating the possibility to recover lost cryptocurrency by enabling the extraction of private keys from public data held in older addresses or those with reused keys. The rapid development in this field, particularly with methods like the Shor algorithm, could soon allow actors to break traditional encryption protecting digital assets. This poses a real and pressing risk to vast reserves of digital currency that were previously considered lost or inaccessible. LINK IMPORTANCE The implications of this technological progression are profound for the blockchain ecosystem, as vast sums in dormant wallets could reenter circulation, altering supply dynamics and market stability. For institutional stakeholders, the threat to current cryptographic security underlines an urgent need to invest in quantum resistant protocols before powerful quantum machines become widely accessible. Senator Lummis says US is ‘waking up’ on crypto after historic legislative week Senator Cynthia Lummis of Wyoming expressed optimism that the United States is making substantive progress in the area of digital asset policymaking after several significant legislative advances in Congress. She credited the passage of key digital asset bills as a sign that policy makers now recognize the importance of regulatory clarity for the crypto industry. LINK IMPORTANCE This development signals a shift in the US regulatory environment for digital assets and marks a potential inflection point in the global competition for fintech leadership. Institutional investors and market participants are likely to see the alignment of bipartisan legislative efforts as a harbinger of reduced policy risk for digital currency and blockchain initiatives. Vietnam deploys national blockchain for identity and records Vietnam has introduced NDAChain as a nationwide data infrastructure aiming to secure and verify digital transactions and records across vital sectors such as government services, finance, healthcare, logistics, and education. NDAChain features a hybrid architecture that combines centralized and decentralized elements. LINK IMPORTANCE The introduction of NDAChain signals Vietnam’s commitment to strengthening national information security and boosting digital trust in public and private service delivery. This deployment lays the groundwork for more resilient IT infrastructure, reducing risks linked to data breaches and centralized models, and facilitating advanced digital interactions such as legally binding e contracts and real time identity verification. Nigeria's securities regulator is openly encouraging the development and operation of stablecoin projects within the country provided these projects adhere to established regulatory frameworks. Emomotimi Agama from the Securities and Exchange Commission confirmed that several firms focused on stablecoin applications have already been admitted to the regulatory sandbox, showing practical momentum in the market. LINK IMPORTANCE This regulatory shift from Nigeria's top financial authority displays forward thinking in integrating blockchain-based financial instruments into the nation's economy. By codifying expectations and requirements for stablecoin projects, authorities send a strong signal to global fintech and crypto innovators that Nigeria is a viable platform for compliant growth and experimentation. The approach is indicates a maturing ecosystem with direct implications for cross-border payments, remittances, and fintech infrastructure across West Africa. Arizona woman sentenced for helping North Korea coders get US crypto jobs Christina Marie Chapman from Arizona has been sentenced to eight and a half years in federal prison for her involvement with North Korean affiliates in a large scale fraudulent operation targeting US cryptocurrency and technology companies. Chapman assisted these operatives by helping them secure remote IT jobs at over three hundred companies using stolen identities and false documentation which led to more than 17 million dollars in illicit revenue for the Democratic Peoples Republic of Korea. LINK IMPORTANCE This case is significant as it highlights the evolving tactics used by nation states like North Korea to circumvent international sanctions and obtain foreign currency through sophisticated cyber enabled employment fraud within the US remote IT and crypto sectors. It underscores growing vulnerabilities in the digital hiring landscape particularly the risks posed by unvetted remote workers who may exploit systemic loopholes for state sponsored financial gain.

|